Mumbai: CREDAI-MCHI, the apex body representing the real estate industry in the Mumbai Metropolitan Region (MMR), has called for a comprehensive review of the Goods and Services Tax (GST) framework affecting the real estate sector.

In a formal submission to the Goa Chief Minister and a member of the GST Council Pramod Sawant, the organization outlined concerns surrounding the impact of GST on redevelopment, affordable housing, and rehabilitation projects.

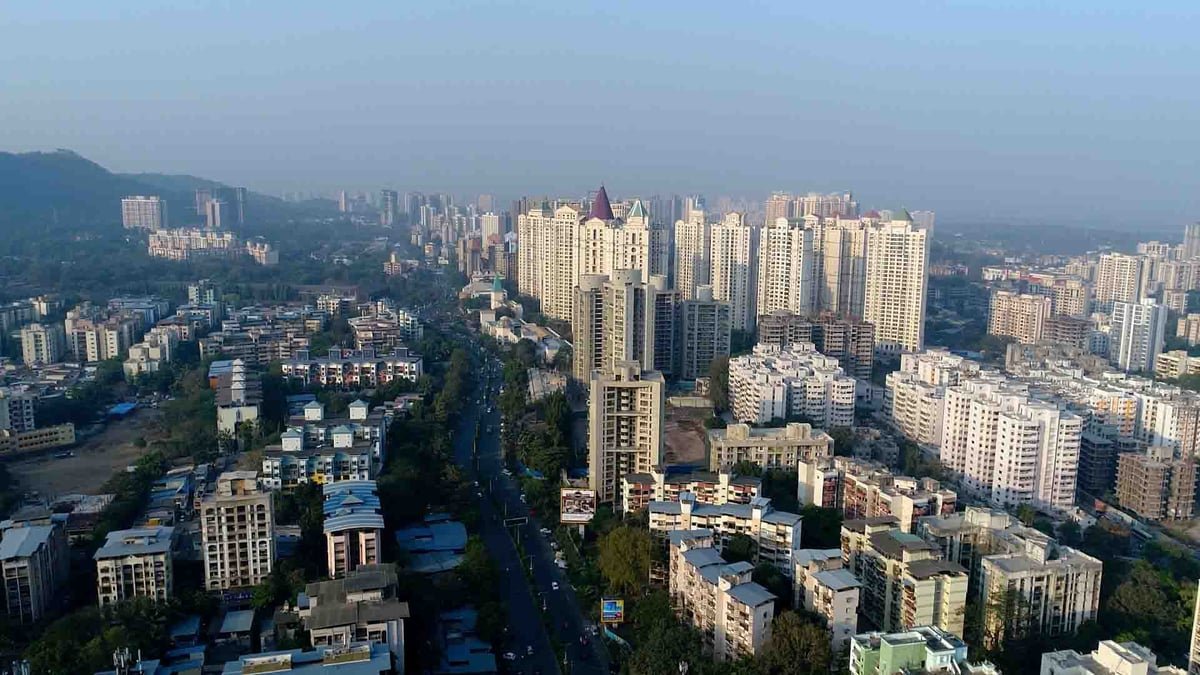

With over 14,000 dilapidated buildings and 70 lakh residents living in slums, Mumbai faces significant housing challenges. Redevelopment is crucial for addressing these issues by creating additional housing stock and improving living conditions.

However, CREDAI-MCHI has raised concerns over the GST imposed on these projects, arguing that it adversely affects both developers and homebuyers. The non-availability of Input Tax Credit (ITC) has increased costs for homebuyers and slowed demand in an already sluggish market.

President of CREDAI-MCHI, Domnic Romell emphasized the financial strain caused by current GST regulations, stating, “The GST implications on redevelopment and rehabilitation projects have placed an undue burden on both developers and homebuyers. We urge the government to reconsider these charges, particularly for projects involving the rehabilitation of slum dwellers and residents of unsafe, dilapidated buildings. The real estate sector, one of the largest employers in both organized and unorganized sectors, is crucial for economic revival. As Mumbai attracts top talent and faces rising housing demand, the city’s geographic constraints hinder its ability to accommodate the growing population effectively.”

CREDAI-MCHI also highlights other pressing issues, including GST on Transfer of Development Rights (TDR) and the Rs 45 lakh limit for affordable housing benefits. Additionally, developers face costs for constructing both rehabilitation and sale buildings, paying GST at rates of 18% or 12% without ITC.

Despite these costs, GST authorities have levied GST on the rehabilitation component of schemes, resulting in slum and dilapidated building occupants being required to pay GST on flats they already own. This levy is seen as anti-poor and contrary to the spirit of the GST regime, amounting to double taxation.

The organization advocates for greater flexibility, proposing that developers should have the option to choose between the 12% GST rate with ITC or the 5% rate without ITC. This flexibility would help ensure ITC cost savings are passed on to homebuyers while allowing developers to continue delivering large-scale affordable housing projects.