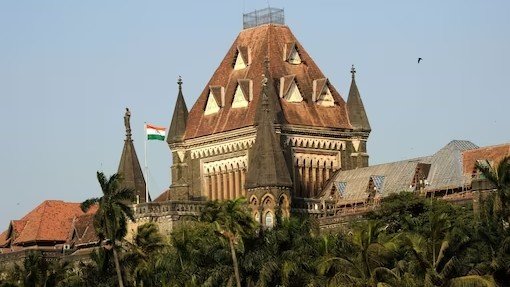

Mumbai: The Bombay High Court on Thursday suspended the sentence of a former Goods and Services Tax (GST) department superintendent who was last week sentenced to four years of simple imprisonment in Rs1.2 crore disproportionate assets (DA) case. The court granted bail to Prasiddh Dubey, 66, on furnishing a personal bond of Rs 15,000.

Vacation judge Justice Sharmila Deshmukh was hearing an appeal by Dubey challenging his sentence by special CBI court on October 23. Pending hearing in appeal, Subey sought bail and suspension of sentence. His advocate contended that he was never arrested and was throughout on bail.

“In the meantime, substantive jail sentence imposed on the Applicant by the judgment dated 23rd October 2024 is suspended… The Applicant be released on bail on furnishing PR bond of Rs.15,000 with one or two sureties of like amount to the satisfaction of the Sessions Court,” the HC said.

The HC has kept Dubey’s appeal for hearing on November 18. The CBI had booked the couple on February 20, 2018, based on secret information about disproportionate assets, alleging that Dubey, while working as superintendent (GST, Audit-1, Mumbai), possessed assets disproportionate to his known source of salary from June 1994 to February 2018.

The investigation revealed that the couple had assets worth Rs 2.03 crore. Besides, it was claimed that after calculation of the income and expenditure, from all sources, the assets were found to be 107.69% more than the couple’s income.

The agency had claimed that Dubey’s assets at the beginning of the check period was Rs 9.11 lakh but at the end of that duration it was Rs 2.44 crore. The prosecution claimed that the properties were acquired by Dubey in the name of his wife.

However, Dubey claimed he did not contribute in acquisition of any properties by Vimla. Further, he claimed that Vimla had an independent source of income, such as her own business of garments, rental income from the properties and also agriculture income. It was further claimed that any property held by Vimla, as the two reside together, cannot be said to have been acquired by her on behalf of her husband, a public servant.

However, CBI contended that though Vimla had an independent source of income, it wasn’t sufficient to acquire these properties.